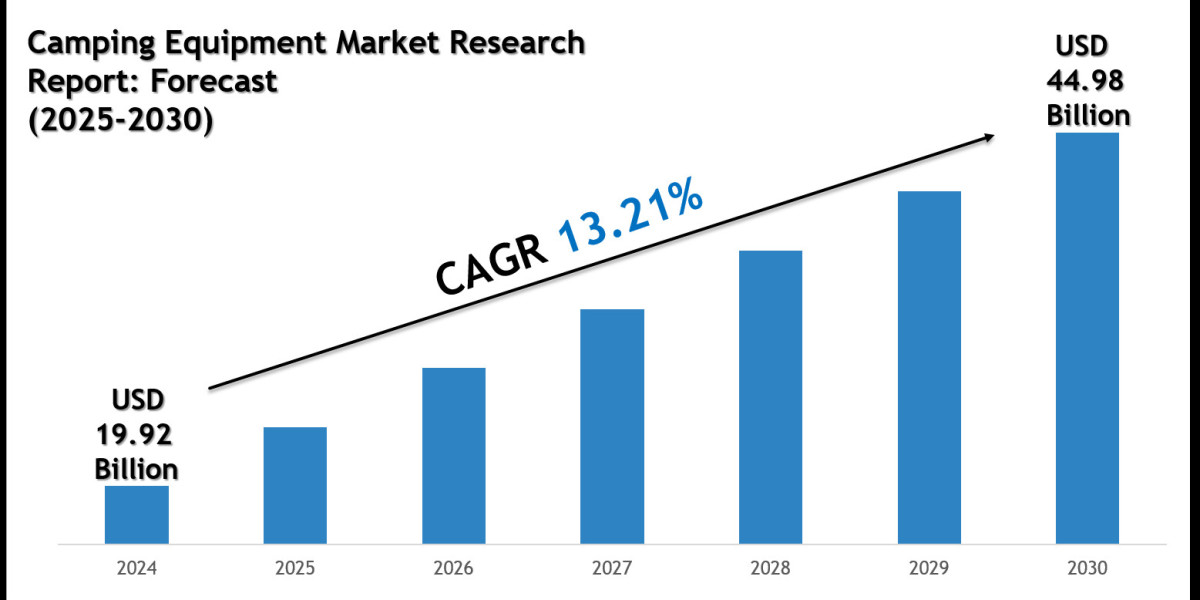

The global Credit Scoring Market Size is experiencing significant growth as financial institutions, fintech companies, and digital lenders increasingly rely on technology-driven solutions for financial risk rating and borrower assessment. With the rise of AI, machine learning, and big data analytics, credit scoring has evolved into a highly predictive and data-rich process that enhances the accuracy and efficiency of lending decisions.

Expanding Role of Credit Scoring Systems

Credit scoring plays a pivotal role in modern financial ecosystems, providing valuable insights into consumer behavior, repayment capacity, and overall creditworthiness. Traditional scoring systems are being replaced by advanced scoring models that integrate alternative data sources such as digital transactions, e-commerce activity, and mobile payment behavior. This transformation enables lenders to extend credit to previously underserved populations, fostering financial inclusion and economic growth.

Technological Advancements Fueling Market Expansion

AI-driven automation and cloud-based analytics platforms are streamlining credit evaluation processes, reducing bias, and improving risk management accuracy. Lenders are now able to assess applicants in real time using lending analytics that combine historical performance with predictive modeling. These innovations are helping institutions reduce default rates while providing personalized credit solutions for both individual and business borrowers.

Moreover, the market’s growth aligns with broader digital financial trends. For instance, the Japan Cyber Insurance Market is advancing digital security and risk protection in financial systems, while the Germany Mobile Banking Market is showcasing the increasing adoption of digital finance platforms that rely heavily on secure, data-driven credit scoring systems.

Market Drivers and Opportunities

The key drivers behind the credit scoring market’s expansion include rising demand for quick credit decisions, increased digitalization of financial services, and the emergence of alternative lending models. Governments and regulatory bodies are also supporting fair and transparent credit assessment frameworks, encouraging innovation while maintaining data protection standards.

Fintech firms are capitalizing on these opportunities by offering AI-based scoring platforms that deliver real-time insights and risk mitigation tools for lenders. This convergence of technology and finance is creating a dynamic ecosystem where accuracy, speed, and inclusivity define success.

Future Outlook of the Credit Scoring Market

Looking ahead, the credit scoring industry is poised for continued expansion as global lending markets embrace digital transformation. Integrating blockchain, decentralized data management, and open banking frameworks will further enhance the transparency and reliability of credit evaluations.

As financial institutions adopt more sophisticated tools, credit scoring will not only remain a cornerstone of lending but also evolve into a vital enabler of personalized and secure financial ecosystems worldwide.

FAQs

1. What is credit scoring and why is it important?

Credit scoring is the process of evaluating an individual’s or business’s creditworthiness using data and algorithms. It helps lenders make informed lending decisions and manage financial risk effectively.

2. How is technology transforming the credit scoring market?

Technologies like AI, big data, and machine learning enhance accuracy, speed, and fairness in credit assessments while reducing operational costs for lenders.

3. What are the main growth factors in the credit scoring industry?

Key factors include digitalization of financial services, the rise of fintech lending platforms, regulatory support for open banking, and increasing demand for real-time credit evaluation.

4. What is the future outlook for the credit scoring market?

The market is expected to grow steadily as digital finance expands, integrating AI, blockchain, and alternative data sources to create more transparent and inclusive credit systems.

? MRFR BFSI Radar: Real-Time Market Updates ➤

E-Commerce Buy Now Pay Later Market

Equity Management Software Market

Factory and Warehouse Insurance Market