Understanding Tax Relief on Charitable Donations in the UK

Charitable giving is a cornerstone of UK society, with millions of individuals and businesses supporting causes they care about. Beyond the altruistic benefits, donating to charities can also yield significant tax advantages. However, navigating the complexities of tax relief on charitable donations can be daunting without professional guidance. This is where a personal tax advisor in the uk becomes invaluable. In this first part of our comprehensive guide, we’ll explore the basics of tax relief on charitable donations in the UK, key statistics, and how a tax advisor can help maximize your benefits. Whether you’re an individual taxpayer or a business owner, understanding these mechanisms can make your generosity more financially rewarding.

The Scale of Charitable Giving in the UK

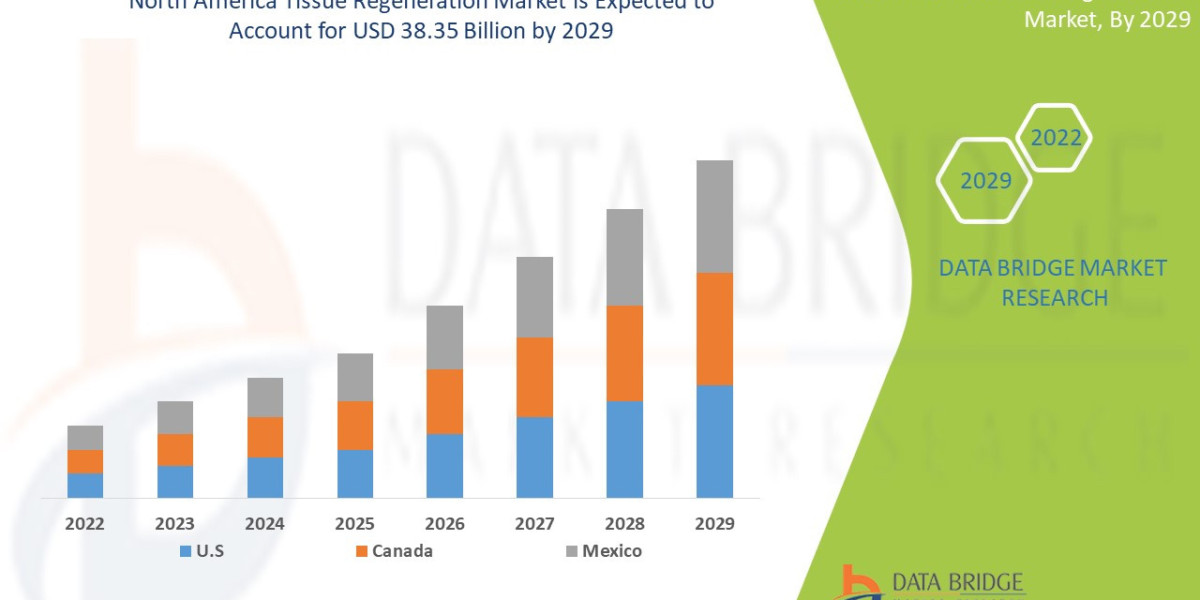

Charitable donations are a significant part of the UK’s economic and social fabric. According to the UK government’s 2024 statistics, charities claimed £1.6 billion in Gift Aid during the tax year ending April 2023, a figure that highlights the scale of tax-efficient giving. For the tax year ending April 2024, the provisional forecast for higher-rate tax relief on donations is £690 million, a 1% increase from the previous year. Additionally, the total value of donations declared via Self Assessment was £3.9 billion, though this was a 3% decrease from the prior year, driven by a reduction in donations of shares and property. Over 66,000 charities benefited from Gift Aid in the most recent year, a 3% rise in the number of organizations receiving such funds.

Businesses also play a significant role, with corporate donations estimated to have cost £880 million in tax relief for the tax year ending April 2022. Furthermore, business rates relief for charities, one of the largest sources of tax relief, was forecast at £2.56 billion for the tax year ending April 2024, up 6% from the previous year. These figures underscore the substantial tax incentives available, but claiming them correctly requires expertise, particularly for complex donations or high-net-worth individuals.

What Is Tax Relief on Charitable Donations?

Tax relief on charitable donations in the UK is designed to encourage giving by reducing the donor’s tax liability or increasing the value of the donation to the charity. The primary mechanisms for individuals include Gift Aid, Payroll Giving, and relief on donations of assets like land, property, or shares. For businesses, tax relief is typically claimed through deductions against Corporation Tax. Here’s a breakdown of the main schemes:

Gift Aid: When you donate to a UK-registered charity or Community Amateur Sports Club (CASC) under Gift Aid, the charity can claim an additional 25p for every £1 donated, funded by HMRC. For example, a £100 donation becomes £125 for the charity at no extra cost to you. If you’re a higher-rate (40%) or additional-rate (45%) taxpayer, you can claim additional relief on the “grossed-up” amount (e.g., £125), reducing your tax bill.

Payroll Giving: This scheme allows employees to donate directly from their salary or pension before tax, providing immediate tax relief at their highest tax rate. For instance, a £20 monthly donation costs a higher-rate taxpayer only £12 after tax relief.

Donations of Assets: Donating land, property, or shares to a charity can yield relief on both Income Tax and Capital Gains Tax (CGT). For example, gifting shares worth £10,000 could save a higher-rate taxpayer £4,000 in Income Tax and exempt them from CGT on any gains.

Inheritance Tax (IHT) Benefits: Leaving 10% or more of your net estate to charity reduces the IHT rate from 40% to 36% on estates worth over £325,000.

Why You Need a Personal Tax Advisor

While these schemes sound straightforward, their application can be complex, especially for high-income individuals or business owners. A personal tax advisor can:

Ensure Eligibility: To claim Gift Aid, you must pay enough Income Tax or CGT to cover the tax reclaimed by the charity (at least 25p per £1 donated). A tax advisor verifies your tax liability to avoid HMRC penalties.

Maximize Relief: Higher-rate taxpayers can claim additional relief, but this requires accurate reporting on your Self Assessment tax return. For example, a £1,000 Gift Aid donation results in a £1,250 gross donation, allowing a 40% taxpayer to claim £250 back (20% of £1,250). A tax advisor ensures you claim the full amount.

Handle Complex Donations: Donating assets like property or shares involves valuing the asset and completing specific sections of your tax return (e.g., boxes 6 and 11 on SA100). A tax advisor navigates these requirements and retains necessary documentation.

Optimize Business Donations: For limited companies, donations are deductible from profits before Corporation Tax, but sponsorship payments must not yield significant business benefits to qualify. A tax advisor ensures compliance and maximizes deductions.

Real-Life Example: Sarah’s Gift Aid Success

Consider Sarah, a higher-rate taxpayer earning £60,000 annually. She donates £2,000 to a local animal shelter under Gift Aid. The charity claims £500 (25%) from HMRC, making the donation worth £2,500. Sarah, paying 40% tax, can claim 20% of the gross donation (£2,500 × 20% = £500) via her Self Assessment, reducing her tax bill. Without a tax advisor, Sarah might have missed this relief, as she was unaware she needed to report the donation on her tax return. Her advisor also recommended consolidating her donations into one tax year to push her income below the personal allowance taper threshold (£100,000), further increasing her tax savings.

The Role of Documentation

Accurate record-keeping is critical for claiming tax relief. For Gift Aid, you need a declaration and proof of donation (e.g., bank statements or charity receipts). For non-cash donations like shares or property, you must retain documents detailing the asset’s value and transfer. HMRC may request these records up to 22 months after the tax year ends. A tax advisor ensures all paperwork is in order, reducing the risk of errors or audits.

Key Considerations for 2025

As of February 2025, several updates affect charitable giving tax relief. From April 2024, tax relief is restricted to UK-registered charities and CASCs, ending relief for donations to EU/EEA charities. Additionally, the Gift Aid Small Donations Scheme, which allows charities to claim relief on small cash donations without declarations, was valued at £30 million for the tax year ending April 2024. A tax advisor stays updated on these changes, ensuring your donations remain tax-efficient.

How a Personal Tax Advisor Enhances Your Charitable Giving Strategy

For UK taxpayers and business owners, charitable donations are not just about supporting worthy causes—they’re also a strategic way to optimize your tax position. A personal tax advisor can transform your giving into a financially savvy decision by tailoring strategies to your unique circumstances. In this second part, we delve into how tax advisors add value, explore advanced tax relief options, and provide a recent case study to illustrate their impact. With the right guidance, you can amplify both your charitable impact and your tax savings.

Strategic Planning for Maximum Tax Relief

A personal tax advisor goes beyond filing forms—they create a tailored plan to align your charitable giving with your financial goals. Here’s how they add value:

Optimizing Gift Aid: For higher-rate (40%) or additional-rate (45%) taxpayers, Gift Aid can significantly reduce tax liabilities. For example, a £5,000 donation becomes £6,250 with Gift Aid, and a 40% taxpayer can claim £1,250 (20% of £6,250) back via Self Assessment. A tax advisor identifies the optimal donation amount to lower your taxable income, potentially keeping you below key thresholds like £50,270 (higher-rate threshold for 2025/26) or £100,000 (personal allowance taper).

Timing Donations: Advisors can recommend “bunching” donations into a single tax year to maximize relief. For instance, combining two years’ donations into one may push your deductions above the standard personal allowance, increasing savings. They also advise on carrying back Gift Aid donations made between 6 April 2025 and the filing date for the 2024/25 tax return to claim relief in the earlier year.

Structuring Asset Donations: Donating shares, land, or property can yield dual relief on Income Tax and CGT. A tax advisor ensures accurate valuation and compliance with HMRC rules, such as reporting in box 6 (shares) or box 10 (property) on your SA100 form. They also advise on selling assets to charities at below market value to claim additional relief.

Inheritance Tax Planning: By including charitable bequests in your will, you can reduce IHT from 40% to 36% if you donate 10% or more of your net estate. A tax advisor structures your will to balance charitable goals with family needs, ensuring tax efficiency.

Business Owners: Leveraging Corporate Donations

Limited companies can deduct charitable donations from profits before calculating Corporation Tax, which is 25% for profits over £250,000 in 2025. A tax advisor helps business owners:

Identify Qualifying Donations: Donations of money, land, shares, or equipment qualify, but sponsorships must not provide significant business benefits (e.g., excessive publicity). Advisors ensure donations meet HMRC criteria to avoid disallowed deductions.

Claim Capital Allowances: Donating equipment allows businesses to claim capital allowances, reducing taxable profits. For example, donating £10,000 worth of office equipment could save £2,500 in Corporation Tax.

Manage Secondments: Loaning employees to charities can qualify as a deductible expense if structured correctly. Advisors ensure proper documentation and compliance.

Case Study: James and His Charitable Trust (2024)

James, a 45-year-old business owner in Manchester, wanted to support a local education charity while reducing his tax burden. His company earned £300,000 in profits, and he personally earned £80,000, placing him in the higher-rate tax bracket. Without a tax advisor, James donated £10,000 via Gift Aid, expecting the charity to claim £2,500 from HMRC. However, he was unaware he could claim additional relief.

In 2024, James hired a tax advisor who devised a comprehensive strategy. First, they recommended increasing his personal donation to £15,000, which, with Gift Aid, became £18,750 for the charity. James claimed £3,750 (20% of £18,750) on his Self Assessment, reducing his tax bill. Second, his company donated £20,000 in equipment, saving £5,000 in Corporation Tax. Finally, the advisor set up a charitable trust, allowing James to donate shares worth £50,000, which saved £10,000 in Income Tax and exempted him from CGT on the shares’ £20,000 gain. The advisor ensured all documentation was HMRC-compliant, and James’s total tax savings exceeded £18,000 while the charity received £68,750 in value. This case highlights how a tax advisor can transform ad-hoc giving into a strategic, tax-efficient plan.

Avoiding Common Pitfalls

Without professional guidance, donors risk costly mistakes:

Overclaiming Gift Aid: If your Income Tax or CGT liability is less than the tax reclaimed by charities (e.g., £2,500 on a £10,000 donation), HMRC may demand repayment. A tax advisor calculates your liability to prevent this.

Missing Deadlines: Gift Aid carry-back claims must be included in your original tax return for the prior year, due by 31 January (online) or 31 October (paper). Advisors ensure timely filing.

Incorrect Asset Valuation: Donating shares or property requires accurate market value assessments. An advisor coordinates with valuers to meet HMRC standards.

Non-Qualifying Donations: Donations to non-UK charities after April 2024 no longer qualify for relief. Advisors verify charity status using HMRC’s charity reference number.

Tools and Resources Advisors Use

Tax advisors leverage tools like HMRC’s Tax Exempt Organization Search to confirm charity eligibility and stay updated on policy changes, such as the April 2024 restriction on non-UK charities. They also use software to model tax scenarios, ensuring your donations align with your overall financial plan. For businesses, advisors integrate charitable deductions into annual accounts, streamlining Corporation Tax returns.

Practical Steps and Advanced Considerations for Tax-Efficient Giving

Maximizing tax relief on charitable donations requires careful planning and execution. A personal tax advisor can guide you through practical steps and advanced strategies to ensure your giving is both impactful and financially beneficial. In this final part, we outline actionable steps for individuals and businesses, explore advanced giving vehicles like charitable trusts, and provide tips for working effectively with a tax advisor. This section is designed to empower UK taxpayers and business owners with the knowledge to make informed decisions.

Step-by-Step Guide to Claiming Tax Relief

A personal tax advisor streamlines the process of claiming tax relief, but understanding the steps can help you collaborate effectively:

Choose a Qualifying Charity: Ensure the charity or CASC is registered with HMRC. Use HMRC’s online charity search tool to verify their reference number. After April 2024, only UK charities qualify for tax relief.

Make a Gift Aid Declaration: When donating cash, complete a Gift Aid declaration (online, on paper, or verbally). This allows the charity to claim 25p per £1 donated. Retain confirmation for your records.

Record Donations: Keep bank statements, receipts, or charity confirmations for cash donations. For shares or property, obtain a valuation and transfer documents. Advisors ensure these meet HMRC’s 22-month retention rule.

Report on Self Assessment: Enter Gift Aid donations in box 5, shares in box 6, and property in box 10 on your SA100 form. For carry-back claims, use box 8. If you don’t file a tax return, contact HMRC to adjust your tax code.

Leverage Payroll Giving: If your employer offers Payroll Giving, donations are deducted pre-tax, providing immediate relief. No need to report these on your tax return.

Plan for IHT: Include charitable bequests in your will to reduce IHT to 36%. A tax advisor can draft a will to optimize this benefit.

Advanced Giving Strategies

For high-net-worth individuals or business owners, a tax advisor can recommend sophisticated approaches:

Charitable Trusts: Setting up a charitable trust allows you to control how funds are used while benefiting from tax exemptions (Income Tax, CGT, IHT). For example, a £100,000 trust donation is tax-free, and the trust itself pays no taxes on its income. Advisors handle legal setup and HMRC registration.

Donor-Advised Funds (DAFs): DAFs are sub-funds within a larger charity, offering flexibility for donors with dual UK/US tax liabilities. A £50,000 DAF donation qualifies for UK and US relief, with the provider managing compliance.

Pre-Eminent Objects: Donating culturally significant items (e.g., art or manuscripts) can yield 30% relief against Income Tax or CGT. Advisors coordinate with HMRC to ensure eligibility.

Bunching Donations: Consolidating donations into one tax year can maximize relief by pushing your income below tax thresholds. For example, a £20,000 donation might save a 40% taxpayer £5,000 by lowering their taxable income below £50,270.

Real-Life Example: Emma’s Estate Planning

Emma, a 60-year-old retiree with an estate worth £500,000, wanted to support a cancer research charity while minimizing IHT. Her tax advisor recommended leaving 10% (£50,000) of her net estate to the charity, reducing the IHT rate on the taxable portion (£175,000 after the £325,000 nil-rate band) from 40% to 36%. This saved £7,000 in IHT (£175,000 × 4%). The advisor also suggested a £10,000 Gift Aid donation during her lifetime, which generated £2,500 for the charity and £2,000 in tax relief for Emma (as a 40% taxpayer). By structuring her will and donations strategically, Emma’s advisor ensured £62,500 went to the charity while saving her estate £7,000 and her personal taxes £2,000.

Working with a Tax Advisor: Tips for Success

To get the most from your tax advisor:

Provide Full Financial Details: Share your income, assets, and donation history to enable precise planning.

Discuss Long-Term Goals: Whether it’s reducing IHT or supporting a specific cause, clarify your objectives.

Review Annually: Tax laws change (e.g., the 2024 non-UK charity rule), so regular reviews ensure compliance.

Choose a Specialist: Select an advisor with experience in charitable giving, such as those at firms like Saffery or Buzzacott, who specialize in tax-efficient philanthropy.

Staying Compliant in 2025

HMRC’s rules are strict, and non-compliance can lead to penalties. For instance, Gift Aid donations must not exceed four times your tax paid in a tax year. A tax advisor monitors this limit and advises on corrective actions if you over-donate. They also ensure donations to non-UK charities before April 2024 are claimed correctly, as relief ended for these entities. For businesses, advisors verify that sponsorships qualify as donations rather than taxable benefits, preserving Corporation Tax relief.