In recent times, the panorama of investment has seen a big shift, notably in the realm of retirement accounts. Among these changes, the inclusion of gold as an investment option inside Individual Retirement Accounts (IRAs) has gained appreciable traction. This text explores the demonstrable advancements in IRA gold investment, focusing on the advantages, regulatory adjustments, and the technological improvements which have made gold investments extra accessible and environment friendly for traders.

Understanding IRA Gold Investment

An IRA (Particular person Retirement Account) permits people to save for retirement with tax benefits. Traditionally, IRAs have been limited to stocks, bonds, and mutual funds. Nonetheless, the introduction of self-directed IRAs has opened the door for a broader vary of funding trusted options for ira rollover precious metals, including valuable metals like gold. Gold IRAs enable investors to incorporate physical gold, silver, platinum, and palladium of their retirement portfolios, offering a hedge against inflation and economic instability.

The Rise of Gold as a Protected Haven

The financial climate has at all times influenced funding decisions. In instances of uncertainty, reminiscent of throughout economic downturns or geopolitical tensions, gold has historically been considered as a safe haven. The current international occasions, together with the COVID-19 pandemic and subsequent inflationary pressures, have heightened interest in gold as a protecting asset. Consequently, extra buyers are contemplating gold IRAs as a viable choice to diversify their retirement portfolios and safeguard their wealth.

Regulatory Adjustments Enhancing Accessibility

One of the significant developments in IRA gold investment has been the evolution of regulations governing precious metal IRAs. The inner Income Service (IRS) has established clear guidelines for what qualifies as acceptable gold for IRA investment. To be eligible, gold must meet specific purity standards (a minimum of 99.5% pure) and be produced by an accepted producer. This clarity has made it simpler for traders to understand the necessities and has fostered a extra clear market.

Moreover, the IRS has allowed for higher flexibility in the types of gold investments that may be included in IRAs. Traders can now choose from various gold products, including bullion coins, bars, and sure forms of gold ETFs (Exchange-Traded Funds). This expanded vary of options has made it possible for traders to tailor their portfolios in line with their particular person threat tolerance and investment objectives.

Technological Improvements in Gold Investment

The appearance of know-how has additionally performed a pivotal role in advancing IRA gold investment. Online platforms and digital marketplaces have emerged, allowing traders to purchase, promote, and manage their gold investments with unprecedented ease. These platforms often provide academic resources, enabling traders to make knowledgeable choices about their gold investments.

Moreover, advancements in blockchain know-how have begun to affect the gold funding panorama. Blockchain offers a secure and clear method to trace possession and provenance of gold, decreasing the chance of fraud and enhancing investor confidence. Some corporations are even exploring the concept of tokenized gold, the place bodily gold is represented by digital tokens on a blockchain, making it easier to trade and manage gold investments inside an IRA.

The Function of Custodians in IRA Gold Investment

A crucial side of IRA gold investment is the role of custodians. The IRS requires that all IRA property, including gold, be held by a professional custodian. This requirement has led to the emergence of specialized custodians who focus exclusively on valuable metals. These custodians offer companies that simplify the technique of investing in gold, including storage solutions, compliance with IRS laws, and reporting.

Many custodians now present secure storage facilities, usually in multiple areas, to ensure the security of the bodily gold. Some even offer insurance options to guard against theft or injury. This level of security and professionalism has made gold IRAs more interesting to investors who may have previously hesitated due to issues concerning the safety of bodily assets.

The Investment Panorama: Developments and Predictions

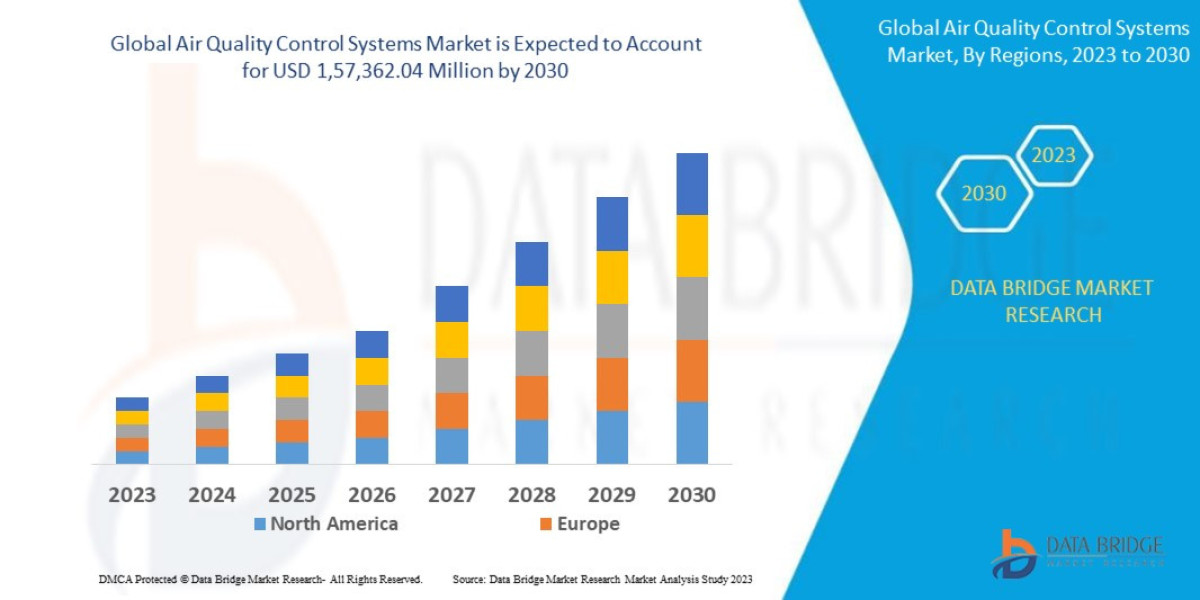

As we glance to the long run, a number of trends are shaping the IRA gold investment landscape. One notable development is the growing awareness of the significance of diversification in investment portfolios. Investors are recognizing that relying solely on traditional assets could expose them to larger danger, prompting a shift toward alternative investments like gold.

Furthermore, as youthful generations begin to take management of their retirement planning, there is a rising interest in tangible assets. Millennials and Gen Z traders, in particular, are drawn to gold as a way to preserve wealth and hedge in opposition to economic uncertainty. This shift in demographics is more likely to drive further innovation in the gold investment area, as corporations adapt their choices to fulfill the preferences of youthful investors.

Conclusion

The developments in IRA gold investment reflect a broader development towards diversification and the inclusion of other assets in retirement planning. If you have any inquiries about in which and how to use best gold ira company list, menwiki.men,, you can contact us at the site. Regulatory adjustments, technological improvements, and the emergence of specialised custodians have made gold investments more accessible and interesting to a wider audience. As financial uncertainties continue to loom, the role of gold in retirement portfolios is more likely to become increasingly distinguished.

Investors trying to secure their financial future ought to consider the benefits of together with gold of their IRA. With its historic significance as a secure haven and the developments in the investment panorama, gold offers a compelling choice for those searching for to protect and grow their wealth in an unpredictable world. Because the market continues to evolve, staying informed about the latest developments in IRA gold investment will likely be essential for making sound investment choices.