Global Explosion Proof Equipment Market Size, Share, and Growth Trends (2025–2032)

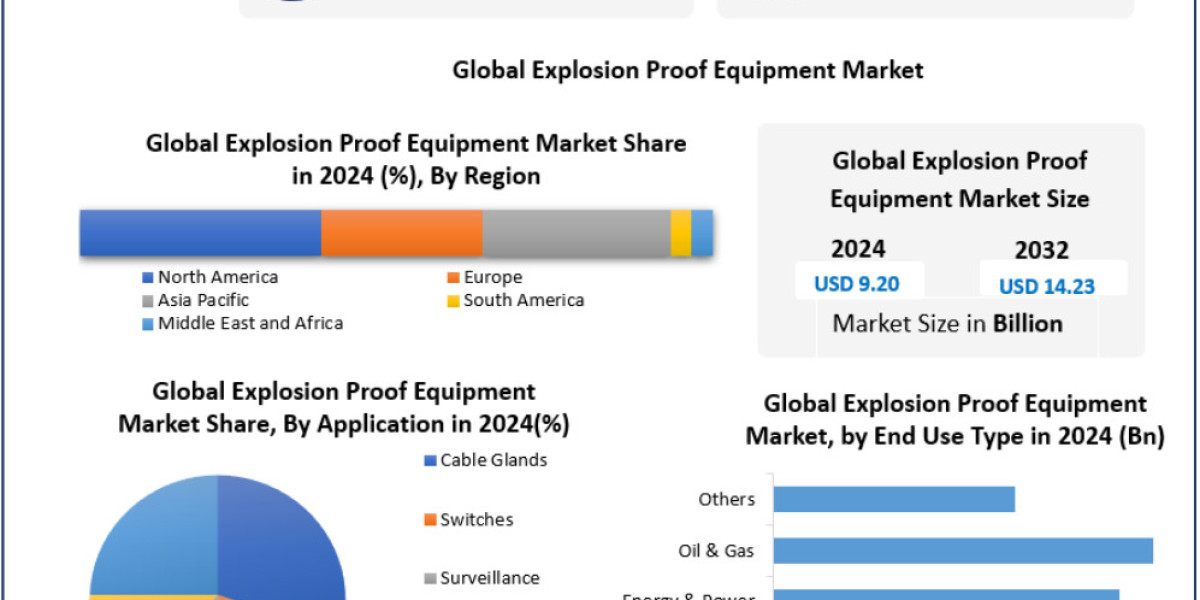

The Global Explosion Proof Equipment Market was valued at USD 9.20 billion in 2024 and is projected to reach USD 14.23 billion by 2032, growing at a CAGR of 5.6% during the forecast period (2025–2032). This growth is fueled by stringent workplace safety standards, industrial modernization, and expanding oil & gas exploration activities worldwide.

Market Overview

Explosion proof equipment includes electrical and mechanical devices specifically designed to operate safely in hazardous environments that contain flammable gases, vapors, dust, or fibers. These systems prevent ignition sources from triggering explosions by utilizing protective design mechanisms such as flameproof enclosures, intrinsic safety barriers, and sealed junction systems.

The market is witnessing accelerated adoption across oil & gas, mining, chemicals, pharmaceuticals, and manufacturing industries, driven by an increasing emphasis on worker safety, equipment reliability, and compliance with international safety standards.

Technological innovations — including AI-assisted hazard detection, smart sensors, and intrinsically safe automation systems — are transforming explosion proof equipment into intelligent safety solutions that enhance operational efficiency and real-time monitoring capabilities.

Growing regulatory enforcement, rising industrial automation, and demand for sustainable safety infrastructure are further propelling market expansion globally.

► Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/117018/

Market Dynamics

Key Drivers

Stringent Government Safety Regulations

Rising incidents of industrial explosions and fire hazards in oil & gas, mining, and chemical sectors have prompted governments to enforce rigorous safety norms. Compliance with standards such as ATEX, IECEx, and NEC mandates explosion proof equipment deployment in high-risk environments.Expanding Industrial and Energy Infrastructure

Increasing energy consumption and ongoing industrialization in emerging economies are spurring investments in refineries, power plants, and manufacturing facilities, boosting demand for explosion proof electrical systems and machinery.Technological Advancements and Smart Safety Systems

Integration of Industrial Internet of Things (IIoT), real-time data analytics, and predictive maintenance systems into explosion proof devices is improving their reliability, reducing downtime, and enabling remote hazard monitoring.

Restraints

High Initial Costs and Design Complexity:

Advanced explosion proof systems are expensive to manufacture, install, and maintain, especially in large-scale industrial applications.Mining Sector Volatility:

Fluctuating commodity prices and uncertain mining output may restrain long-term demand in this key end-use segment.

Opportunities

Wireless and Miniaturized Equipment:

The rise of compact, modular, and wireless explosion proof devices is creating new opportunities for integration in space-constrained industrial zones and offshore facilities.Emerging Market Demand:

Developing economies in Asia-Pacific, the Middle East, and Africa are witnessing rapid adoption of explosion proof technologies due to new refinery, energy, and infrastructure projects.

Segment Analysis

By Method

Prevention Segment:

Dominated the market in 2024 with the largest share. Prevention-based designs limit electrical discharge, preventing ignition of hazardous gases or vapors. Increasing use of intrinsically safe circuits and smart prevention systems supports this segment’s continued growth.Containment and Segregation:

Expected to experience steady demand in industrial plants where flammable materials are handled in confined environments.

By Zone Type

Zone 0:

Expected to grow at the highest CAGR of 5.9% during the forecast period. It includes areas continuously exposed to explosive atmospheres, requiring maximum protection.Zone 1 and Zone 2:

These zones, where flammable materials are present intermittently, continue to witness widespread adoption across process industries.

By Application

Cable Glands:

Accounted for the largest market share (30.7%) in 2024. Cable glands are vital for sealing and securing electrical cables entering explosion proof enclosures and junctions.Lighting Systems, Switches, and Surveillance:

These applications are expanding rapidly due to increasing infrastructure upgrades in energy, manufacturing, and marine industries.

By End-Use

Oil & Gas Industry:

The dominant end-user segment, growing at a CAGR of 5.7%. Explosion proof systems are extensively used in drilling operations, LNG facilities, and refineries to minimize fire risks and enhance equipment reliability.Chemicals & Pharmaceuticals:

Growing safety investments in production and storage areas are driving demand for sealed electrical and control systems.

► Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/117018/

Regional Insights

North America

North America held the largest share of the global explosion proof equipment market in 2024. The region’s growth is underpinned by:

Established oil & gas, mining, and chemical industries,

Strict OSHA and NEC safety regulations, and

Rapid adoption of digital safety systems and intrinsically safe devices.

Major market players and heavy investments in industrial automation and infrastructure modernization in the U.S. and Canada continue to strengthen the region’s leadership.

Europe

Europe represents a mature market, driven by stringent ATEX certification standards and strong presence of industrial automation players like Siemens AG, ABB Ltd, and Schneider Electric. The region is also emphasizing sustainable and smart safety solutions.

Asia Pacific

The fastest-growing regional market, fueled by industrial expansion, refinery projects, and energy infrastructure investments in China, India, and Southeast Asia. Increasing adoption of local manufacturing, coupled with cost-effective solutions from Chinese and Indian suppliers, supports the region’s competitiveness.

Middle East & Africa

The MEA region is witnessing growth due to oil & gas exploration and chemical plant expansion. The GCC countries are key contributors, focusing on workplace safety modernization.

South America

Countries such as Brazil and Argentina are adopting explosion proof technologies for energy, mining, and petrochemical applications, supported by growing regulatory oversight.

Competitive Landscape

The global market features a mix of leading multinational corporations and specialized regional manufacturers competing through innovation, certifications, and customized safety solutions.

Leading Companies:

Eaton Corporation (USA)

ABB Ltd. (Switzerland)

Rockwell Automation, Inc. (USA)

Honeywell International Inc. (USA)

Siemens AG (Germany)

Emerson Electric Co. (USA)

Pepperl+Fuchs GmbH (Germany)

R. Stahl AG (Germany)

Bartec GmbH (Germany)

Schneider Electric SE (France)

Notable Developments:

March 2025: Eaton Corporation showcased its latest intrinsically safe systems and explosion-proof cameras at Automation Expo South 2025 in Chennai, India.

June 2024: Fuji Electric Co., Ltd. introduced its UL-certified EXV1000-7W explosion-proof blower for hazardous ventilation.

March 2024: Emerson Electric Co. launched the Rosemount SAM42 Acoustic Particle Monitor, enhancing predictive maintenance in oil & gas wells.

June 2024: Honeywell International Inc. acquired Enraf Holding B.V. to expand its explosion-proof metering solutions.

Emerging Market Trends

Integration with Industrial IoT (IIoT):

Smart explosion proof systems enabling real-time condition monitoring and predictive maintenance.Miniaturization & Modular Design:

Development of lightweight, space-efficient explosion proof devices tailored for compact industrial setups.Wireless Safety Communication Systems:

Rapid rise in wireless transmitters and explosion-proof mobile communication technologies to enhance mobility and monitoring.

Conclusion

The Explosion Proof Equipment Market is evolving rapidly as industries prioritize safety, automation, and digital integration. While high implementation costs and technical complexities remain challenges, innovations in IIoT-enabled safety systems, miniaturized designs, and regulation-compliant technologies are redefining global safety standards. The market’s steady expansion underscores its critical role in ensuring safe and sustainable industrial operations across all major sectors.