Lately, the world of investment has undergone important transformations, with traditional assets like stocks and bonds dealing with volatility as a consequence of financial instability, inflation, and geopolitical tensions. In consequence, traders are more and more looking for different avenues to preserve and develop their wealth. One such possibility that has gained traction is gold investing by Particular person Retirement Accounts (IRAs). This article explores the demonstrable advances in IRA gold investing, highlighting its benefits and the present landscape for traders.

Understanding IRA Gold Investing

IRA gold investing allows people to include physical gold and different precious metals of their retirement portfolios. Not like traditional IRAs that usually hold paper assets, gold IRAs allow traders to diversify their holdings with tangible assets. This diversification can function a hedge against inflation and market downturns, making gold a horny possibility for lengthy-term wealth preservation.

The Rise of Gold IRAs

The resurgence of interest in gold as a protected-haven asset can be attributed to a number of factors. Economic uncertainty, rising inflation rates, and fluctuating forex values have prompted buyers to reconsider their portfolios. Gold has historically been considered as a retailer of value, and its value usually rises throughout times of financial distress. In the event you loved this information and you would like to receive details with regards to best precious metals ira companies please visit the web-page. As a result, many are turning to gold IRAs to safeguard their retirement financial savings.

Advances in Gold IRA Services

One of the most notable advances in IRA gold investing is the proliferation of specialised custodians and repair suppliers. In the past, buyers confronted challenges to find reputable corporations to facilitate gold IRA transactions. Right this moment, numerous corporations offer comprehensive services, together with account setup, custodianship, and storage reliable options for ira rollover investments for bodily gold. These advancements have made it easier for people to invest in gold within their retirement accounts.

- Streamlined Account Setup: Trendy gold IRA suppliers have simplified the account opening course of, permitting buyers to ascertain their accounts on-line with minimal paperwork. This efficiency is essential for attracting new investors who could also be hesitant to navigate complex procedures.

- Various Investment Options: Buyers now have entry to a broader vary of gold merchandise that can be included in their IRAs. Beyond traditional gold coins and bars, many custodians supply options similar to gold ETFs (exchange-traded funds) and mining stocks, providing extra flexibility in investment strategies.

- Transparent Charge Buildings: Transparency in payment constructions has turn out to be a hallmark of respected gold IRA suppliers. Traders can now simply examine prices related to account upkeep, storage, and transaction fees, enabling them to make informed selections and keep away from hidden charges.

Regulatory Framework and Compliance

The evolution of IRA gold investing has additionally been accompanied by a extra strong regulatory framework. The interior Income Service (IRS) units particular guidelines for the types of gold and precious metals that can be included in retirement accounts. These rules be certain that buyers are purchasing qualifying property, which must meet certain purity requirements.

- IRS-Authorized Metals: Investors can now confidently select from an inventory of IRS-accredited gold bullion coins and bars, ensuring compliance and minimizing the danger of penalties. This readability has made it simpler for buyers to navigate the market.

- Enhanced Safety Measures: With the rise in curiosity comes the necessity for enhanced security. Many gold IRA custodians now supply secure options for ira precious metals rollover storage solutions, together with insured vaults and segregated storage choices. These measures provide peace of mind for traders involved about the security of their physical property.

The Function of Technology

Technological advancements have also played a pivotal position in the growth of IRA gold investing. The integration of know-how into the investment course of has made it extra accessible and consumer-pleasant.

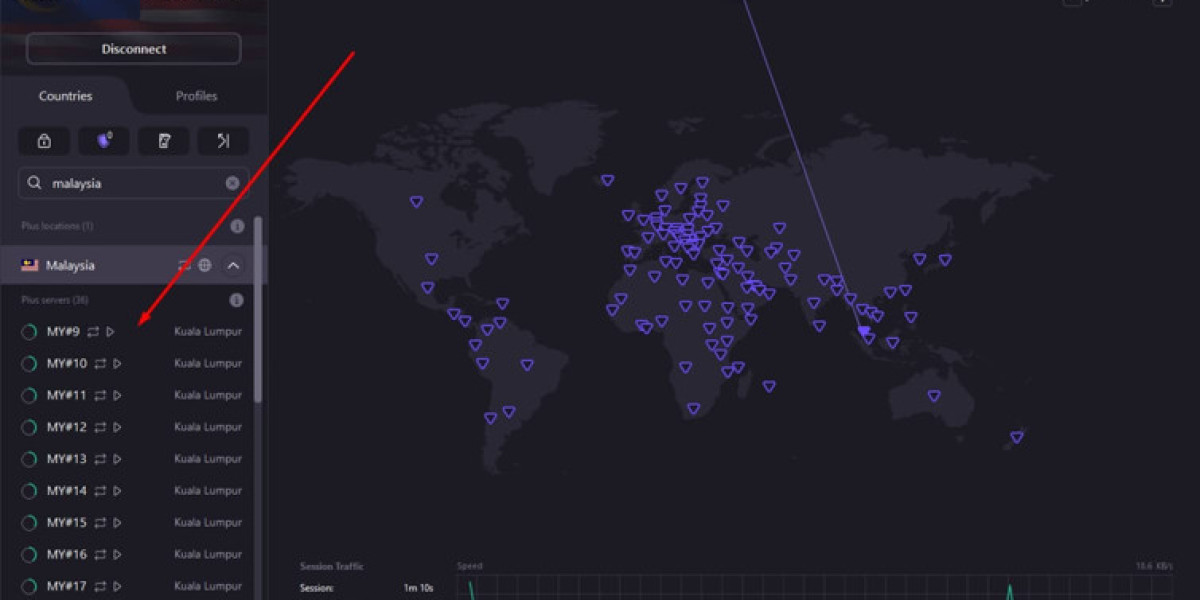

- Online Platforms: Many gold IRA providers now offer online platforms that enable investors to manage their accounts, monitor performance, and execute transactions with ease. This accessibility appeals to a tech-savvy era of buyers who desire digital solutions.

- Educational Assets: The availability of educational assets on-line has empowered buyers to make knowledgeable choices. Webinars, articles, and movies on gold investing methods, market developments, and IRA laws are readily accessible, helping individuals navigate the complexities of gold IRAs.

The advantages of IRA Gold Investing

Investing in gold by an IRA affords several benefits that make it an appealing alternative for retirement planning.

- Hedge Towards Inflation: Gold has traditionally maintained its value throughout inflationary periods. By including gold in an IRA, traders can protect their buying energy and guarantee their retirement savings retain their worth over time.

- Portfolio Diversification: Gold typically moves independently of traditional asset classes, making it an effective instrument for diversification. A well-diversified portfolio can mitigate risks and enhance overall returns.

- Tax Advantages: Gold IRAs present the same tax advantages as traditional IRAs. Traders can defer taxes on features until they withdraw funds throughout retirement, allowing their investments to develop tax-free within the interim.

- Tangible Asset Ownership: Not like stocks or bonds, gold is a bodily asset that investors can hold. This tangibility can present a way of safety, especially throughout financial turmoil.

Conclusion

Because the funding landscape continues to evolve, IRA gold investing stands out as a viable option for individuals searching for to preserve and develop their wealth. The advances in custodial services, regulatory compliance, and know-how have made it simpler than ever for traders to incorporate gold of their retirement portfolios. With its historical repute as a protected-haven asset, gold remains a compelling alternative for these trying to navigate financial uncertainties and safe their monetary future. Traders excited by gold IRAs ought to conduct thorough analysis, compare providers, and consider their long-term financial targets before making any funding selections. In doing so, they'll harness the advantages of gold investing and enhance their retirement strategy.