Automotive Engineering Services Market – Global Industry Analysis & Forecast (2025–2032)

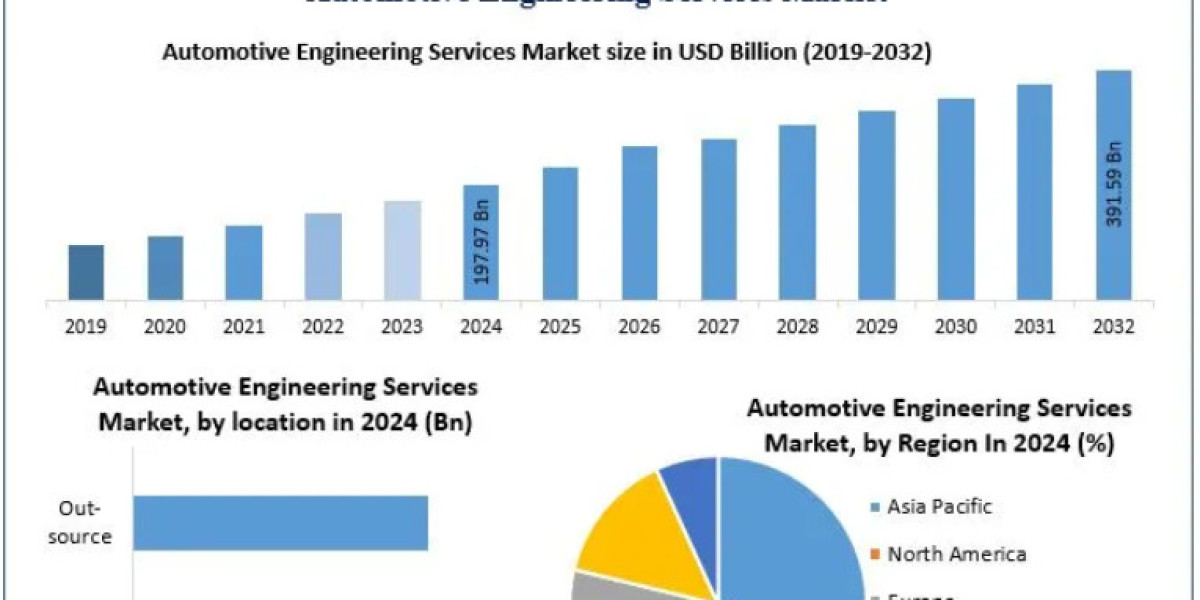

The Automotive Engineering Services Market, valued at USD 197.97 billion in 2024, is projected to grow at a CAGR of 8.9%, reaching USD 391.59 billion by 2032. This growth is driven by rapid technological advancements, rising EV adoption, digital transformation among OEMs, and the increasing complexity of modern vehicle systems.

Market Overview

Automotive engineering services support OEMs and Tier-1 suppliers in digitizing product development, reducing manufacturing costs, and accelerating time-to-market. These services span:

Vehicle design & engineering

Powertrain development

Connected vehicle technologies

Autonomous systems

Product lifecycle management (PLM)

Testing, prototyping, and validation

The growing shift toward electrification, connectivity, and autonomous mobility is significantly expanding the need for highly specialized engineering capabilities.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/32395/

Market Dynamics

1. Rising R&D Investment by Automotive OEMs – A Key Growth Driver

Major automakers including Volkswagen, BMW, Daimler, Renault, and Ford continue to invest heavily in R&D to enhance vehicle performance, safety, and digital functionalities.

Higher competition and shorter product development cycles are pushing OEMs to outsource engineering to:

Improve quality

Reduce development costs

Achieve regulatory compliance

Accelerate innovation in ADAS, EVs, and connectivity

2. Growing Adoption of Autonomous Vehicles

Autonomous vehicles rely on advanced engineering disciplines such as:

AI & machine learning

Radar and LiDAR integration

Computer vision

Real-time software validation

Driverless cars help reduce human-error-related accidents and enhance mobility for elderly or disabled populations.

Companies like Ford, which targets commercial autonomous vehicle deployment, accelerate demand for engineering services in simulation, sensor fusion, and safety systems.

3. IP Restrictions Remain a Major Challenge

Outsourced engineering firms often work with multiple clients, making intellectual property management a significant concern.

Challenges include:

Restrictions on reusing patented technologies

Risk of unintentional IP overlap

Long development timelines due to proprietary systems

Strict IP frameworks increase costs and complexity for service providers.

4. COVID-19 & Global Economic Slowdowns

Economic uncertainties and supply chain disruptions impacted R&D investments, particularly in ICE technologies. However, recovery is strong due to renewed EV demand and accelerated digitalization initiatives.

Segment Analysis

By Service Type

Prototype/Prototyping Services – Largest Market Share (2024)

Growth is supported by the rising use of 3D printing & CAD for:

Rapid prototyping

Error detection

Cost-efficient product validation

Testing Services – Fastest Growing Segment (CAGR ~30%)

Driven by stringent regulatory requirements and new test facility investments.

Example: Bertrandt AG invested USD 17 million to expand its high-voltage testing capabilities.

By Location Type

Outsourced Engineering – Leading & Fastest Growing Segment

Outsourcing is increasing due to:

Need for specialized skills

Demand for faster product development

Rising software complexity (cybersecurity, ADAS, BMS, OTA updates)

Major outsourcing partners include Bertrandt, Altran, ALTEN, FEV Group, EDAG, and AVL.

By Application

Connectivity Services – Fastest Growing Application

Driven by the global rollout of 5G, enabling:

V2X (Vehicle-to-Everything)

High-speed data sharing

Infotainment solutions

Over-the-air updates

5G enhances autonomous operations, remote diagnostics, and IoT-based smart mobility.

EV & Battery Engineering

Growing demand for battery management systems, charger testing, and motor control services is reshaping engineering needs.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/32395/

Regional Insights

1. Asia Pacific – Dominant Region (42% Share in 2024)

Growth drivers:

Rapid EV adoption in China

Expanding automotive production in India, Japan, South Korea

Government policies targeted at reducing emissions

Asia Pacific is becoming a global hub for automotive production and engineering.

2. North America – Rapid Growth Ahead

High investment in autonomous mobility, ADAS, and EV technologies drives strong demand for engineering services.

3. Europe – Strong Market Driven by Innovation

Home to several engineering giants and automotive OEMs leading in:

EV adoption

Autonomous systems

Vehicle safety regulations

Key Market Players

United States

Altair Engineering

HARMAN International

EPAM Systems

GlobalLogic

Belcan

Europe

Alten Group

Altran (Capgemini Engineering)

ESI Group

FEV Group

Bertrandt AG

EDAG Group

Bosch

Continental AG

Asia-Pacific

L&T Technology Services (India)

HCL Technologies (India)

Onward Technologies (India)

Horiba Ltd. (Japan)

Others

Ricardo (UK)

AKKA Technologies (Belgium)

Valmet Automotive (Finland)

Semcon (Sweden)

AVL List GmbH (Austria)

Market Outlook (2025–2032)

The future of the automotive engineering services market will be shaped by:

Expansion of EV and hybrid vehicle development

Increased reliance on cloud-based engineering tools

Growing demand for autonomous driving technologies

Rising adoption of connectivity & 5G-enabled vehicle platforms

Shift toward software-defined vehicles (SDVs)

By 2032, engineering services will be central to innovation in mobility, sustainability, and digital transformation.