The global Core Banking Solution Industry is undergoing a significant transformation as financial institutions embrace next-generation digital technologies to enhance performance, security, and customer experience. Modern banks rely heavily on advanced banking software and centralized system architectures to manage account management operations, streamline transaction processing, and support large-scale digital core platform ecosystems.

As consumer expectations rise and financial services shift toward full digitalization, core banking platforms have become essential for enabling rapid product deployment, real-time data visibility, and seamless integration with mobile banking and fintech services. This modernization is helping banks stay competitive, reduce operational costs, and provide more personalized financial solutions.

Digital payment ecosystems also play an increasingly important role in shaping the future of banking. The France Payment Service Market is contributing to the growth of fast, secure, and customer-centric payment channels, which directly integrate with core banking infrastructure. Meanwhile, innovation in the Fintech Lending Market demonstrates how banks and fintech platforms can collaborate through unified systems to deliver automated lending, efficient risk management, and enhanced credit accessibility.

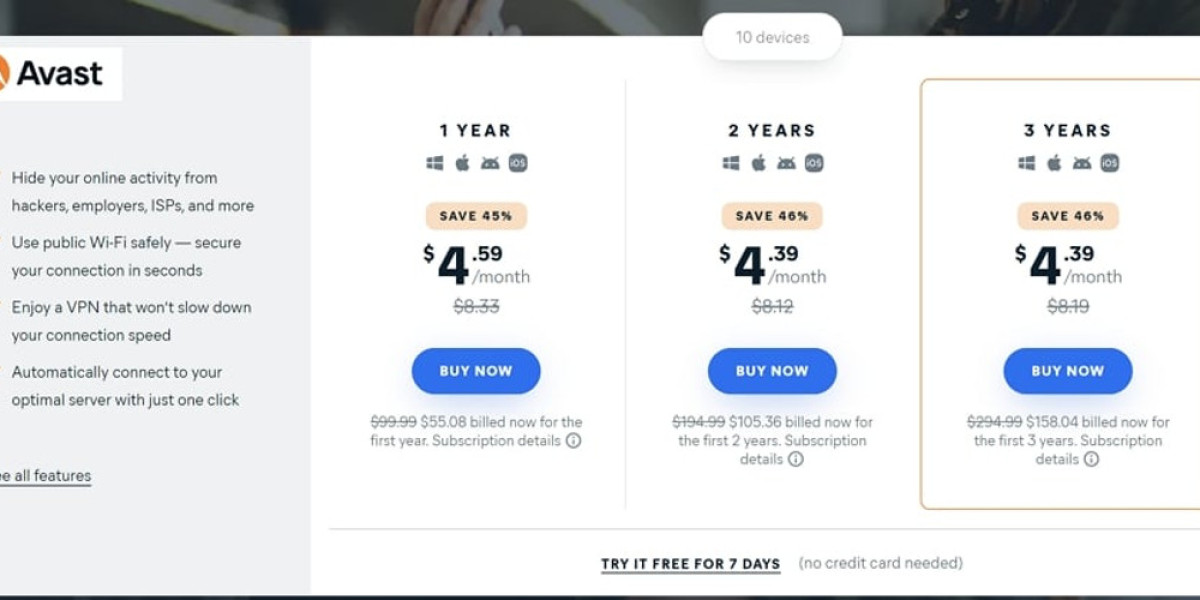

Looking forward, the Core Banking Solution sector is expected to witness strong growth driven by cloud migration, API-driven banking, real-time analytics, and AI-enabled decision-making tools. With increasing focus on scalability, cybersecurity, and omnichannel delivery, financial institutions are adopting flexible digital foundations that support long-term competitiveness and regulatory compliance.

FAQs

1. What is a core banking solution?

A core banking solution is a centralized platform used by financial institutions to manage customer accounts, transactions, and various banking operations efficiently and securely.

2. Why are core banking systems important for modern banks?

They enable real-time processing, digital service delivery, seamless integration with payment ecosystems, and improved customer experience across multiple channels.

3. What trends are shaping the Core Banking Solution Industry?

Cloud-based platforms, API integration, digital payments, AI adoption, and enhanced cybersecurity frameworks are key drivers of industry evolution.

4. How will the future of core banking evolve?

Banks will continue shifting toward scalable, cloud-native systems with intelligent automation, enabling faster innovation and improved operational agility.

? MRFR BFSI Radar: Real-Time Market Updates ➤

wearable healthcare devices market