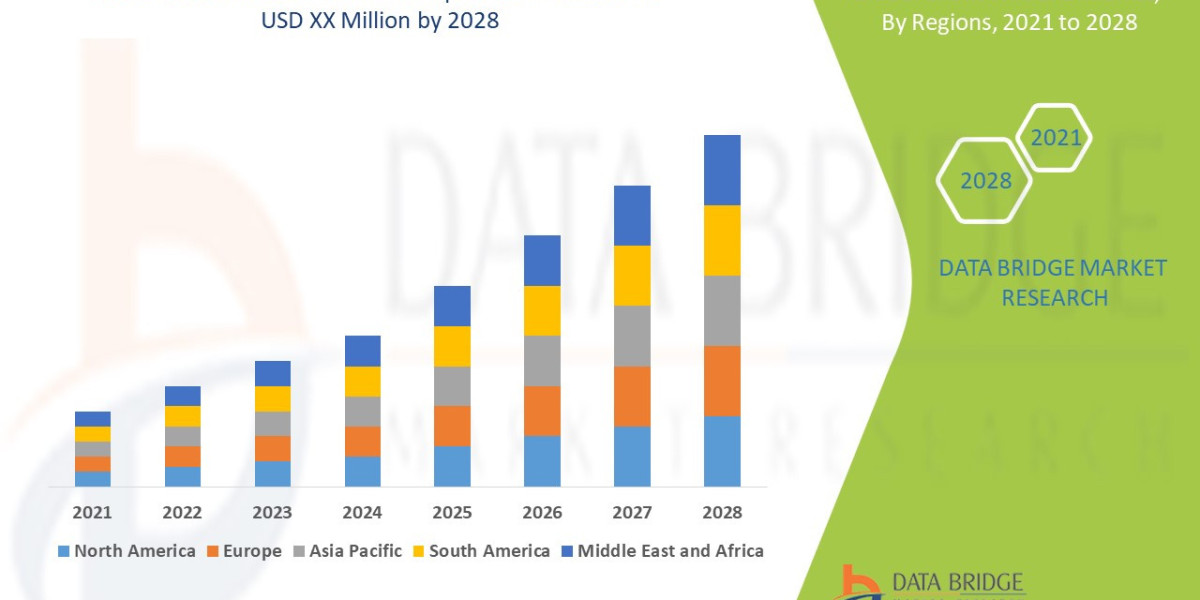

The global Instant Payments Industry is rapidly redefining the financial landscape by enabling real-time transfers, instant money transfer capabilities, and seamless mobile transaction experiences across consumer and business segments. As digital commerce accelerates and customers demand immediate payment confirmation, instant payment networks provide fast settlement, enhanced transparency, and improved reliability across domestic and cross-border transactions. This evolution has positioned instant payments as one of the most vital components of modern financial infrastructure.

Driven by digital transformation, financial institutions, fintech providers, and payment networks are adopting advanced architectures that support 24/7 availability, secure processing, and high-volume digital payment flows. Businesses increasingly rely on instant settlement systems to reduce operational delays, improve liquidity, and strengthen customer satisfaction. With mobile-first consumers expecting frictionless payment journeys, the Instant Payments Industry continues to expand through innovation in authentication tools, API-driven connectivity, and automated transaction management.

Growth across related financial markets further strengthens the digital ecosystem supporting instant payments. The Brazil Property Insurance Market is adopting digital tools that enhance policy management and allow seamless claim payouts via instant payment channels. Similarly, the Student Loan Market highlights how financial service providers are leveraging automated payment solutions and real-time disbursement systems to streamline lending operations. These developments demonstrate the broader role of instant payments in improving speed, accuracy, and accessibility across financial services.

As global commerce becomes increasingly interconnected, instant payment platforms are integrating advanced technologies such as AI-driven fraud detection, digital identity verification, and blockchain-based tracking systems. These improvements create more secure and resilient payment environments while supporting regulatory compliance and consumer protection. The future of the Instant Payments Industry will be shaped by cross-border integration, open banking frameworks, and enhanced interoperability, paving the way for unified global payment experiences.

FAQs

1. What are instant payments?

Instant payments are digital transactions processed in real time, allowing funds to be transferred and received within seconds, 24/7.

2. Why are instant payments becoming essential?

They offer fast settlement, improved transparency, better cash flow management, and seamless user experiences that align with growing digital payment adoption.

3. Which industries benefit from instant payment systems?

Retail, financial services, insurance, lending, e-commerce, and gig economy platforms all benefit from immediate transaction capabilities and reduced processing delays.

? MRFR BFSI Radar: Real-Time Market Updates ➤

wearable healthcare devices market

us managed security services market 2025 pdf