Global Bus Market – Industry Outlook, Trends, Dynamics, and Forecast (2025–2032)

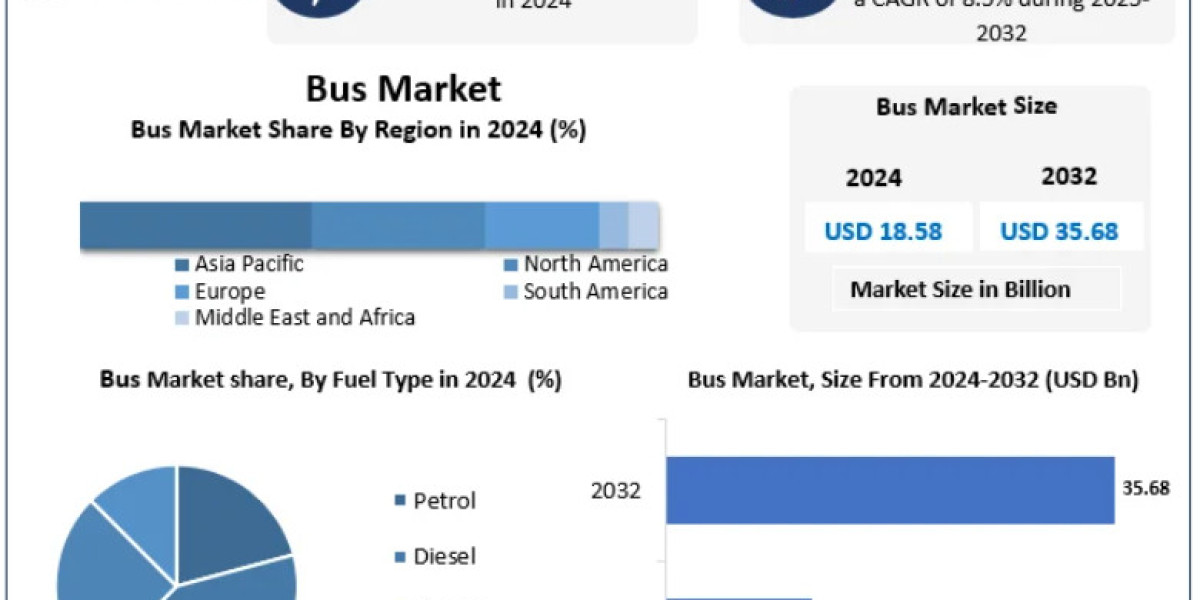

The Global Bus Market, valued at USD 18.58 billion in 2024, is projected to reach USD 35.68 billion by 2032, expanding at a CAGR of 8.5% during the forecast period. The market continues to gain momentum due to rising urban populations, increasing demand for sustainable public transportation, electrification of fleets, and strong government support for low-emission mobility. As cities worldwide upgrade transportation systems to handle congestion, pollution, and mobility needs, buses remain an indispensable mobility solution.

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/211011/

Market Overview

Growing urbanization, population expansion, and the push for eco-friendly mobility systems are shaping the global bus market landscape. Government policies supporting public transport infrastructure—such as charging stations, bus depots, urban transit corridors, and modernization programs—are driving greater adoption of transit buses, school buses, and intercity coaches.

Technological transformation is also reshaping the market. Electric and hybrid buses, intelligent fleet management systems, autonomous driving technologies, and connected solutions are increasingly becoming part of next-generation public transport systems. As a result, the bus market is experiencing rapid evolution, with global OEMs and transit agencies stepping up investments in clean mobility.

Market Dynamics

1. Growing Investments in Public Transport & Bus Infrastructure

Compared with rail projects, bus transportation solutions are more cost-effective and quicker to deploy. Hence, many governments and transit bodies are prioritizing investments in bus modernization, electric bus procurement, and charging infrastructure.

Recent examples include:

- Proterra securing USD 200 million from Cowen Sustainable Advisors and others, accelerating EV bus development.

- Infrastructure investments in bus terminals, charging points, and depots expanding worldwide.

- India’s ambitious move to develop Sky Bus (suspended monorail) systems, with the initial 10.5 km route planned in Goa and similar systems already functioning in Japan, Germany, China, and the USA.

These infrastructural advancements will significantly strengthen global bus fleet modernization.

2. Electrification: The Dominant Market Trend

Electric buses (E-Buses) are the fastest-growing segment globally. Key growth drivers include:

- Climate goals and air quality improvement initiatives

- Government subsidies, tax incentives, and EV mandates

- Lower operating costs due to minimal mechanical components and reduced maintenance

- Zero tailpipe emissions and reduced noise levels

Across the globe, cities are increasingly swapping diesel buses for electric fleets.

For instance:

- As of April 2022, NFI Group Inc. had 8,908 buses on order, with 17% being zero-emission, and 43% of active bids were for electric models.

Electric buses deliver a quiet, clean, and comfortable ride—boosting passenger satisfaction and public acceptance.

3. Slow but Steady Growth in Private Bus Demand

Private bus demand is rising gradually for purposes such as:

- Corporate employee transport

- Event logistics (concerts, weddings, sports events)

- Airport shuttle services

- Luxury tourism buses and custom-designed specialty coaches

Growing transportation needs in tourism, hospitality, and corporate sectors are expanding this segment.

4. Challenges: Traffic Congestion & Fuel Price Volatility

Key restraints include:

- Urban congestion, which reduces the efficiency and reliability of bus fleets

- Fluctuating fuel prices, which increase operational costs for diesel bus operators

- Insufficient or aging bus terminals, depots, and stops, which reduce service attractiveness

Despite these obstacles, technological improvements and electrification are helping mitigate long-term challenges.

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/211011/

Regional Insights

Asia Pacific – Global Leader in 2024

The Asia Pacific region dominated the global market, driven by:

- Large populations and rapid urbanization

- Massive public transport requirements

- Government-led mobility reforms

China leads the world in bus production and electric bus adoption, with major manufacturers such as BYD, Yutong, and King Long.

India—with OEMs like Tata Motors, Ashok Leyland, and Mahindra & Mahindra—is expanding bus fleets for urban transport, schools, and intercity travel.

Europe – Strong Growth Backed by Emission Norms

Europe’s market is driven by:

- Strict Euro Emission Standards

- Rapid adoption of electric and hybrid buses

- High-quality public transit systems

Germany remains the largest contributor in Europe, known for premium engineering in city buses, intercity buses, and long-distance coaches.

North America – Rising Electrification

North America is witnessing rising adoption of transit buses and school buses.

Key highlights:

- Greyhound operates a vast bus network across the U.S., Canada, and Mexico.

- School districts are rapidly transitioning to electric school buses (ESBs) — over 12,275 ESBs committed across 38 states as of 2022.

- Clean fuel technologies like CNG and propane buses are also gaining popularity.

Segment Analysis

By Type

- Transit Bus (Largest Segment) – Driven by urbanization, sustainability goals, and government support

- School Bus

- Coach/Intercity Bus

- Shuttle Bus

- Others

By Fuel Type

- Petrol

- Diesel

- Electric (Fastest Growing)

- Others

By Seating Capacity

- 15–30 Seats

- 31–50 Seats

- More than 50 Seats

Transit buses dominate due to expanding public transport networks, real-time tracking technology, and investments in electric mobility.

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/211011/

Competitive Landscape

The global bus industry features strong competition, featuring continuous investments, mergers, technological advancements, joint ventures, and partnerships.

Key Activities Include:

- Integration of smart tech: autonomous driving, telematics, connected bus systems

- Partnerships for electric batteries (e.g., Proterra & LG Energy Solutions)

- Public transit collaborations (e.g., Proterra & Miami-Dade County)

- New product launches & fleet upgrades

Notable collaborations:

- BYD & Castrosua launched their first jointly manufactured eBus in May 2023

- FirstGroup showed interest in acquiring UK operator Ensignbus in 2023

Key Players in the Bus Market

- Ashok Leyland

- Tata Motors Limited

- Anhui Ankai Automobile Co. Ltd

- BYD Company Limited

- Alexander Dennis

- King Long United Automotive Industry Co. Ltd

- Yutong Bus Co., Ltd.

- Zhongtong Bus Holding Co. Ltd

- NFI Group Inc.

- AB Volvo

- Solaris Bus

- Daimler Truck Holding AG

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd

- Mercedes-Benz Group AG

- New Flyer Industries

- Mahindra & Mahindra

- Proterra

- VDL Bus & Coach

- JBM Group

- Otokar

- Temsa

- Traton Group (Volkswagen AG)

- SML ISUZU Ltd.

- Ebusco

- Irizar Group

- Plus other regional manufacturers

Conclusion

The global bus market is on a strong growth trajectory driven by urban mobility needs, electrification trends, government policy support, and ongoing modernization of public transportation systems. Electric buses will dominate future demand, while connected and autonomous technologies will further redefine bus operations in the coming decade.

As cities prioritize sustainability and efficiency, investments in next-generation buses and supporting infrastructure are expected to create vast opportunities for manufacturers and technology partners worldwide.