Global Crowdfunding Market Size to Reach USD 5.43 Billion by 2033, Fueled by Digital Innovation and Expanding Startup Culture

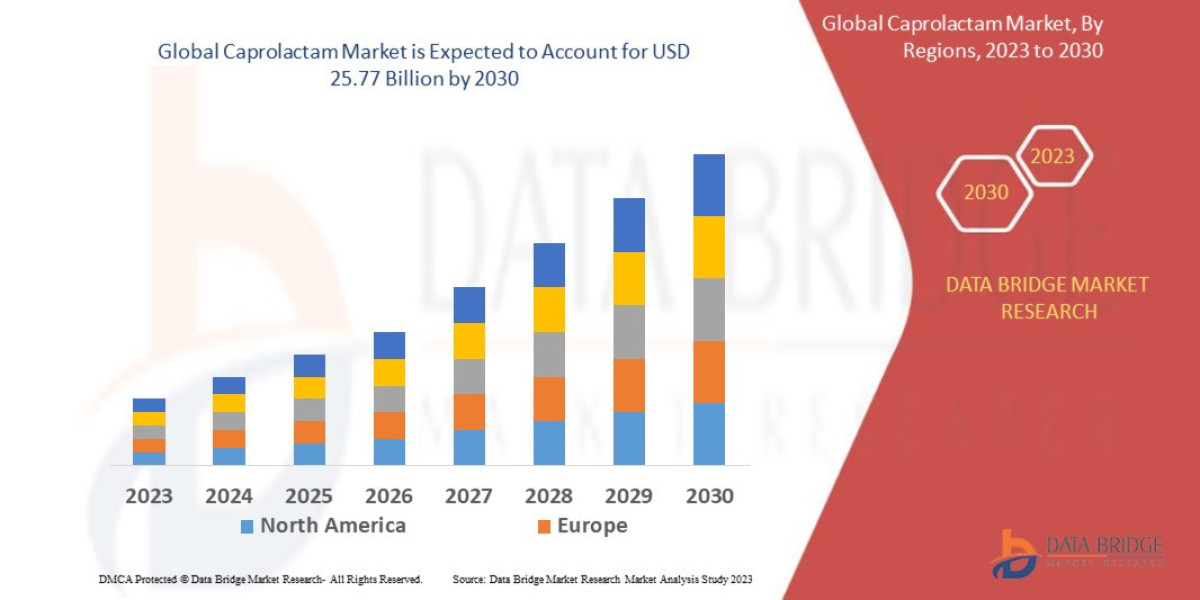

The Global Crowdfunding Market is projected to surge from USD 1.45 billion in 2024 to USD 5.43 billion by 2033, expanding at a robust CAGR of 15.80% during the forecast period. The growth is driven by rising digital penetration, increased social media engagement, and a global shift toward decentralized, democratized financing models.

? Market Overview: The Rise of Democratized Finance

Crowdfunding is a disruptive financial innovation that leverages small contributions from large numbers of people—usually via online platforms—to fund projects, startups, and causes. This model breaks traditional fundraising barriers, offering a path for early-stage ideas to gain traction and support from a broader audience.

The global crowdfunding ecosystem is structured into various models:

- Reward-Based: Backers receive a product or service in return.

- Equity-Based: Investors gain a stake in the project or company.

- Debt-Based: Borrowers repay contributors with interest.

- Donation-Based: Contributors support charitable causes without returns.

This innovative ecosystem empowers creators, social entrepreneurs, and startups to bypass conventional banking systems and venture capital channels—while allowing investors to diversify their portfolios and engage in purpose-driven investing.

⚙️ Key Growth Drivers: What’s Fueling the Market?

? 1. Globalization and Market Accessibility

The expansion of cross-border commerce, removal of trade barriers, and evolution of fintech regulations have allowed crowdfunding platforms to attract a global investor base. Entrepreneurs from emerging markets now have direct access to global capital, while investors can tap into high-growth opportunities globally.

? 2. Tech Innovation: Blockchain, AI & IoT Integration

Crowdfunding is rapidly becoming more sophisticated, integrating cutting-edge technologies:

- Blockchain ensures transparency and security.

- AI/ML enhances campaign targeting and success predictions.

- IoT improves product validation for hardware-focused campaigns.

Notably, Jurny, an AI-powered hospitality platform, launched a StartEngine campaign to democratize early-stage investment access—reflecting a broader trend of startups combining crowdfunding with future-focused tech.

? 3. Social Media as a Crowdfunding Catalyst

Social media is now the engine of campaign virality. Platforms such as Facebook, LinkedIn, Instagram, Reddit, and TikTok allow campaign creators to build communities and trust—essential ingredients for successful funding. Studies show:

- 53% of email shares lead to donations.

- 12% of Facebook shares and 3% of Twitter shares convert to contributions.

Examples include TipSnaps, a creator monetization platform, and success stories like Robinhood and SpaceX that tapped into equity crowdfunding via Republic.

? Regional Insights: Market Penetration Across Continents

?? United States – The Global Leader in Crowdfunding

The U.S. continues to dominate with platforms like Kickstarter, Indiegogo, and GoFundMe. The JOBS Act and strong startup culture have institutionalized equity crowdfunding. Over 72,000 startups operate in the U.S., presenting huge opportunities for decentralized financing.

?? India – Explosive Growth Through Tech & Purpose

India’s crowdfunding scene is thriving due to increasing digital adoption and a booming startup ecosystem. Platforms such as Ketto, Milaap, and Wishberry are popular for medical, educational, and social campaigns. The market is bolstered by rising youth engagement and regulatory shifts from SEBI.

?? Germany – Innovation Meets Regulation

Germany’s mature market is led by platforms like Seedmatch and Companisto, with strong traction in real estate and equity crowdfunding. The introduction of the European Crowdfunding Service Providers Regulation (ECSPR) adds investor protections and scalability across EU borders.

?? Saudi Arabia – Policy-Driven Expansion

Saudi Arabia's Vision 2030 is accelerating the adoption of alternative finance. Platforms like Falak and Eureeca are gaining ground, supported by the Capital Market Authority (CMA). Crowdfunding is emerging as a key funding tool for real estate, tech, and social initiatives.

? Market Segmentation: Crowdfunding by Type and Application

➤ By Type

- Reward-Based Crowdfunding

- Equity-Based Crowdfunding

- Debt-Based Crowdfunding

- Donation-Based Crowdfunding

- Others

➤ By Application

- Technology

- Media & Entertainment

- Food & Beverage

- Healthcare

- Real Estate

- Others

New Publish Blogs:

Top Limestone Companies Dominating the Global Market

Top Salmon Fish Companies Driving Global Aquaculture

Top Menswear Companies Shaping Men’s Fashion in 2025

? Regional Analysis Breakdown

North America

- United States

- Canada

Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Netherlands

- Belgium

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Thailand

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

? Competitive Landscape: Key Companies

Major players are competing on platform technology, investor services, and compliance. Key market participants include:

Company | Overview | Key Developments |

Kickstarter, PBC | Pioneering reward-based platform | Expansion in Europe and new funding tools for creators |

Indiegogo, Inc. | Focused on innovation and hardware | New AI-integrated campaign optimization |

GoFundMe | Leading in donation-based models | Partnered with NGOs for global impact |

Crowdcube | UK-based equity platform | Merged with Seedrs to expand EU presence |

SeedInvest Technology, LLC | Equity-focused in the US | Acquired by Circle to integrate blockchain solutions |

Fundly | Social fundraising platform | AI-enhanced user engagement tools |

Fundable | Hybrid of equity and reward-based | Expanded B2B campaigns |

Alibaba Group Holding Ltd | Diversifying into P2P finance | Launched a platform for SMEs |

? Conclusion: The Road Ahead

The Global Crowdfunding Market is undergoing a radical transformation fueled by digitization, financial democratization, and rising entrepreneurial ambition. As regulatory environments mature and global internet penetration increases, crowdfunding is set to become a core pillar of early-stage financing.

About Renub Research

Renub Research is a leading market research and consulting company offering management consulting and in-depth industry analysis across various sectors. With a global perspective and a local understanding, Renub Research delivers insights that matter.

About the Company:

Renub Research is a Market Research and Consulting Company. We have more than 15 years of experience especially in international Business-to-Business Researches, Surveys and Consulting. We provide a wide range of business research solutions that helps companies in making better business decisions. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our wide clientele comprises major players in Healthcare, Travel and Tourism, Food Beverages, Power Energy, Information Technology, Telecom Internet, Chemical, Logistics Automotive, Consumer Goods Retail, Building, and Construction, Agriculture. Our core team is comprised of experienced people holding graduate, postgraduate, and Ph.D. degrees in Finance, Marketing, Human Resource, Bio-Technology, Medicine, Information Technology, Environmental Science, and many more.

Media Contact:

Company Name: Renub Research

Contact Person: Rajat Gupta, Marketing Manager

Phone No: +91-120-421-9822 (IND) | +1-478-202-3244 (USA)

Email: mailto:rajat@renub.com