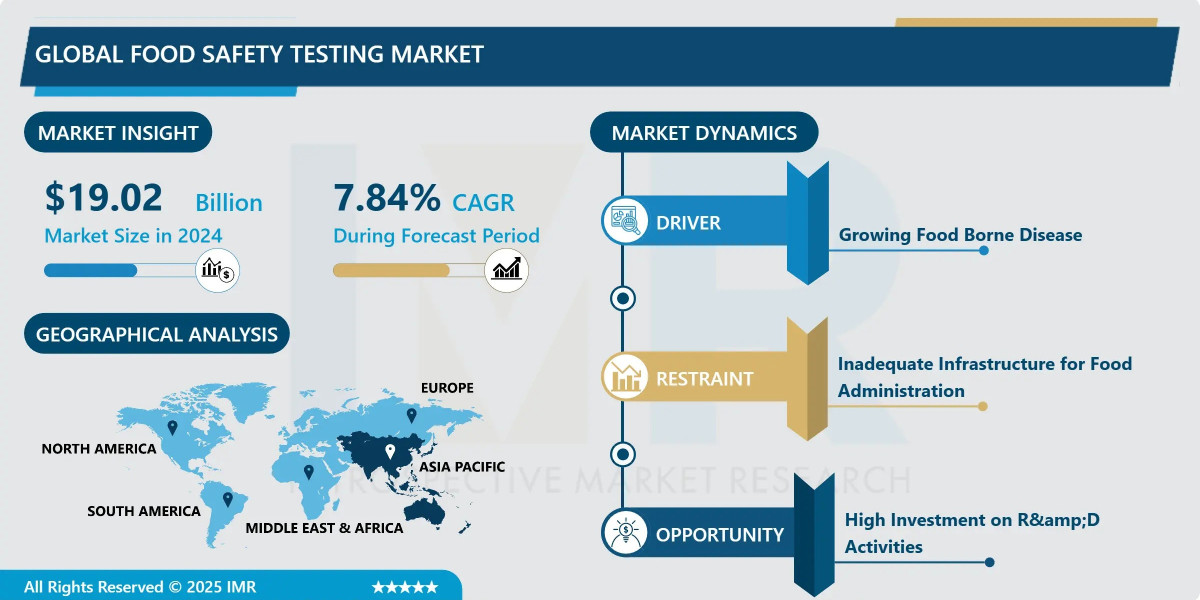

“According to a new report published by Introspective Market Research, titled, Food Safety Testing Market by Test Type, Application, and Region, The Global Food Safety Testing Market Size Was Valued at USD 19.02 Billion in 2024 and is Projected to Reach USD 34.79 Billion by 2032, Growing at a CAGR of 7.84%.”

2. Introduction / Market Overview

The Food Safety Testing Market is defined as the global industry providing analytical services, equipment, and consumables used to ensure food and beverage products are safe for consumption, free from harmful contaminants, and compliant with regulatory standards. This essential process involves rigorous analysis of samples across the entire supply chain, from raw ingredients and manufacturing environments to finished goods, checking for microbiological, chemical, and physical hazards.

Food safety testing offers a critical advantage over unchecked production by proactively preventing foodborne illnesses and costly product recalls. It utilizes advanced techniques like Polymerase Chain Reaction (PCR) and chromatography to detect pathogens such as Salmonella and E. coli, pesticides, heavy metals, allergens, and genetically modified organisms (GMOs) at minute concentration levels. This vigilance is crucial in maintaining consumer trust, facilitating global food trade, and ensuring brand integrity.

Food safety testing is a necessary component across nearly all segments of the global food system. Main uses include certifying raw agricultural products (cereals, grains, fruits, and vegetables), validating processing hygiene in meat and poultry plants, verifying allergen-free claims in processed foods, and ensuring quality control for dairy and seafood products. Its increasing importance is driven by the globalization of supply chains, which increases complexity and the potential for contamination across borders

???????? ???? ??? ?????? ???????: https://introspectivemarketresearch.com/request/15733

.

3. Market Segmentation

The Food Safety Testing Market is segmented into Test Type, Application, and Region. By Test Type, the market is categorized into (Pathogen Testing, Allergen Testing, GMO Testing, Mycotoxin Testing, Pesticide & Residue Testing). By Application, the market is categorized into (Meat, Poultry, & Seafood Products, Dairy Products, Processed Food, Cereals & Grains, Beverages). By Region, the market is categorized into (North America, Asia-Pacific, Europe).

4. Growth Driver

The primary growth driver for the Food Safety Testing Market is the convergence of increasing global foodborne disease incidence and the implementation of stringent, preventative food safety regulations. Rising consumer awareness and the growing complexity of international food trade have pushed governments worldwide to enact comprehensive legislation, such as the Food Safety Modernization Act (FSMA) in the U.S. and the General Food Law Regulation in the E.U. These mandates shift the focus from responding to contamination outbreaks to preventing them, necessitating mandatory, rigorous, and routine testing for pathogens, chemical residues, and allergens at every stage of production. This regulatory pressure, combined with the rising public health concern over recurrent food contamination, forces manufacturers and suppliers to invest heavily in reliable third-party and in-house testing services to ensure compliance and avoid severe penalties or brand damage.

5. Market Opportunity

A key market opportunity lies in the accelerating adoption of rapid diagnostic technologies and the integration of automation and data science (Industry 4.0) into the testing workflow. Traditional culture-based methods are time-consuming, but the demand for quick decision-making is fueling the shift toward rapid testing solutions like quantitative PCR (qPCR), immunoassays, and biosensors. Furthermore, the market is seeing a significant opportunity in integrating these rapid tests with analytical platforms that leverage Artificial Intelligence (AI) and Machine Learning (ML). These advanced systems enable real-time, non-destructive monitoring, predictive analytics for contamination risks, and improved data management, allowing food manufacturers to achieve faster time-to-result, enhance testing accuracy, and ensure higher throughput across increasingly automated processing lines.

6. Detailed Segmentation

Title: Food Safety Testing Market, Segmentation

Line below: The Food Safety Testing Market is segmented on the basis of Test Type, Application, and Region.

Test Type The Test Type segment is further classified into Pathogen Testing, Allergen Testing, GMO Testing, and Mycotoxin Testing. Among these, the Pathogen Testing sub-segment accounted for the highest market share in 2024. This dominance is driven by the high public health risk and economic burden associated with foodborne illnesses caused by bacteria like Salmonella, E. coli, and Listeria. Due to the increasing prevalence of these outbreaks and stricter zero-tolerance policies set by regulators for meat, poultry, and dairy, testing for microbial contaminants remains the fundamental and most frequent requirement across the entire food supply chain. Furthermore, technological advancements in molecular diagnostic techniques, such as PCR and Next-Generation Sequencing (NGS), have enhanced the speed and accuracy of pathogen detection, further solidifying this segment's leading position.

Application The Application segment is further classified into Meat, Poultry, & Seafood Products, Dairy Products, Processed Food, Cereals & Grains, and Beverages. Among these, the Meat, Poultry, & Seafood Products sub-segment is anticipated to show the fastest growth by 2032. This expansion is fueled by the inherent microbial risks in these protein sources and the intense regulatory scrutiny they face globally. Contamination can occur at multiple stages, from slaughtering and processing to distribution. The segment requires high-volume testing for pathogens and antibiotic residues. Additionally, rising global consumption of high-value protein sources and the expansion of complex cold chain logistics amplify the need for stringent and non-negotiable safety standards and continuous testing protocols to prevent massive recalls and protect consumer health.

7. Some of The Leading/Active Market Players Are-

- SGS S.A. (Switzerland)

- Eurofins Scientific SE (Luxembourg)

- Intertek Group PLC (UK)

- Bureau Veritas (France)

- ALS Limited (Australia)

- Thermo Fisher Scientific Inc. (US)

- NEOGEN Corporation (US)

- Mérieux NutriSciences (US)

- TÜV SÜD (Germany)

- Bio-Rad Laboratories (US)

- QIAGEN (Germany)

and other active players.

8. Key Industry Developments

News 1: In August 2024, ALS launched its InviRapid Lateral Flow Assays for rapid, on-site detection of food allergens. This development focuses on providing a quick, easy-to-use solution that allows food manufacturers to conduct immediate and reliable testing for common allergens directly within their processing facilities. This on-site capability significantly reduces the time required for results, allowing swift preventive measures against cross-contamination and aiding in better compliance with complex global allergen labeling mandates.

News 2: In January 2023, Eurofins Scientific introduced a new rapid pathogen detection platform, BactiQuant MQS+, utilizing advanced molecular sequencing technology. This innovative platform is designed to identify foodborne pathogens like Salmonella and Listeria in less than 24 hours. The focus is on providing high-speed, high-accuracy testing essential for time-sensitive supply chains, dramatically shortening the turnaround time compared to traditional culture methods and enhancing the industry’s ability to respond to immediate food safety threats.

9. Key Findings of the Study

- Dominant segments: Pathogen Testing (Test Type) holds the largest market share, while Meat, Poultry, & Seafood Products (Application) is expected to show the fastest growth.

- Leading regions: North America and Europe are the largest markets due to stringent regulations, though Asia-Pacific is projected to record the fastest growth driven by rapid industrialization and growing consumer demand for safety.

- Key growth drivers: Stringent global regulatory compliance and the increasing incidence of foodborne diseases are the primary drivers.

- Market trends: High industry momentum toward the integration of AI-driven diagnostics, automation, and rapid testing technologies (PCR/biosensors) to enhance speed and accuracy.