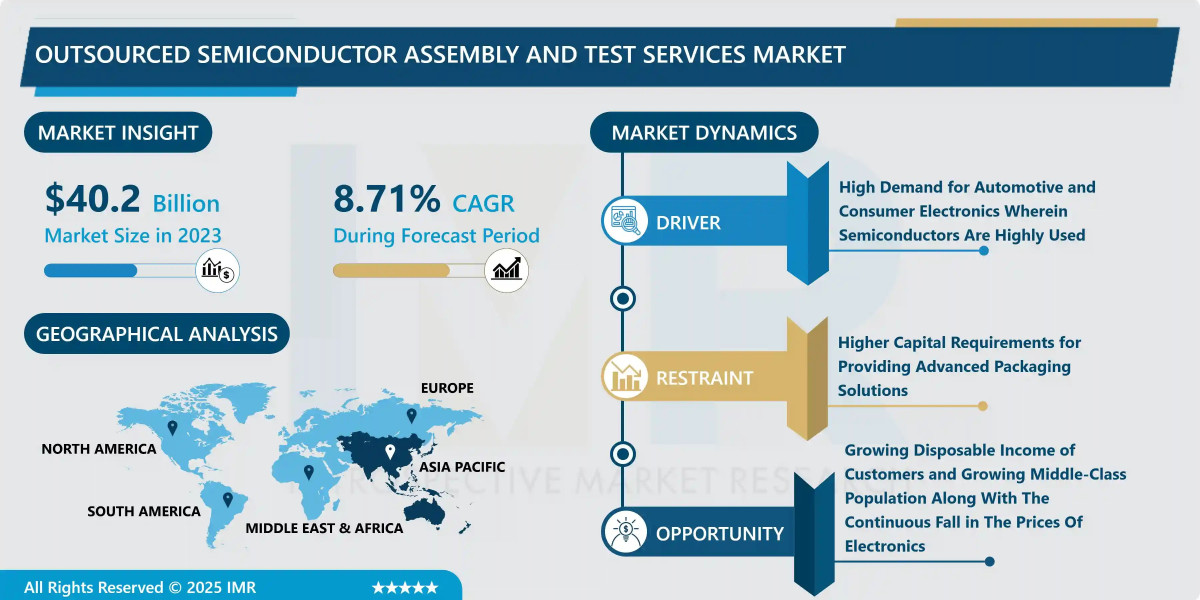

According to a new report published by Introspective Market Research, titled, Outsourced Semiconductor Assembly and Test Services (OSAT) Market by Service, Packaging Type, and Application, The Global Outsourced Semiconductor Assembly and Test Services (OSAT) Market Size Was Valued at USD 40.20 Billion in 2023 and is Projected to Reach USD 85.24 Billion by 2032, Growing at a CAGR of 8.71%.

Introduction / Market Overview

Outsourced Semiconductor Assembly and Test (OSAT) services refer to third-party providers that offer integrated circuit (IC) packaging and testing solutions to semiconductor companies. OSAT vendors handle the crucial back-end manufacturing processes, which involve taking a processed silicon wafer from a foundry and preparing it for use in an electronic device. This includes dicing the wafer into individual chips, packaging them for protection and connectivity, and conducting rigorous testing to ensure functionality and reliability.

The primary advantage of the OSAT model is that it allows fabless semiconductor companies, and even Integrated Device Manufacturers (IDMs), to access advanced packaging and testing capabilities without the substantial capital investment required for in-house facilities. This lowers barriers to entry, accelerates time-to-market, and allows companies to focus on their core competency of chip design. OSATs are indispensable partners in the supply chains for major industries like communications, consumer electronics, automotive, and high-performance computing.

Market Segmentation

The Outsourced Semiconductor Assembly and Test Services (OSAT) Market is segmented into Service, Packaging Type, and Application. By Service, the market is categorized into Assembly & Packaging and Testing. By Packaging Type, the market is categorized into Ball Grid Array (BGA), Chip Scale Package (CSP), System-in-Package (SiP), and Wafer-Level Packaging (WLP). By Application, the market is categorized into Communications, Consumer Electronics, Automotive, and Computing & Networking.

Growth Driver

A key growth driver for the OSAT market is the escalating complexity and cost of advanced packaging technologies. As Moore's Law slows, the industry is turning to innovative packaging solutions like 2.5D/3D stacking and fan-out wafer-level packaging (FOWLP) to achieve performance gains. These technologies require immense R&D investment and specialized manufacturing expertise, which is often beyond the scope of individual chip companies. OSATs, with their dedicated focus and scale, are at the forefront of this transition, providing the critical capabilities needed to package sophisticated chips for AI, 5G, and high-performance computing applications.

Market Opportunity

A major market opportunity lies in the rise of the chiplet ecosystem and heterogeneous integration. Instead of designing large, monolithic SoCs (System-on-a-Chip), companies are developing smaller, specialized chiplets that can be combined within a single package to create a powerful system. This approach requires highly advanced packaging to connect the chiplets with high-speed, low-latency interconnects. OSAT providers are uniquely positioned to capitalize on this trend, acting as essential integration hubs. By offering robust System-in-Package (SiP) platforms, they can enable the creation of next-generation devices and solidify their critical role in the future of semiconductor manufacturing.

Outsourced Semiconductor Assembly and Test Services (OSAT) Market, Segmentation

The Outsourced Semiconductor Assembly and Test Services (OSAT) Market is segmented on the basis of Service, Packaging Type, and Application.

Service

The Service segment is further classified into Assembly & Packaging and Testing. Among these, the Assembly & Packaging sub-segment accounted for the highest market share in 2023. This segment constitutes the core of the OSAT value proposition, involving the intricate process of enclosing a semiconductor die in a supportive case that prevents physical damage and allows electrical contacts to be connected to a printed circuit board. As chip designs become more complex and require advanced interconnect solutions, the value and technical expertise associated with packaging services continue to grow, cementing this segment's dominant position.

Application

The Application segment is further classified into Communications, Consumer Electronics, Automotive, and Computing & Networking. Among these, the Communications sub-segment accounted for the highest market share in 2023. This is primarily driven by the massive volume of smartphones, which are packed with a multitude of advanced chips requiring sophisticated packaging, such as RF modules, application processors, and memory. The ongoing global rollout of 5G infrastructure and devices further fuels demand in this segment, requiring highly integrated and power-efficient packages that are a specialty of leading OSAT providers.

https://introspectivemarketresearch.com/request/16164

Some of The Leading/Active Market Players Are-

· ASE Technology Holding Co., Ltd. (Taiwan)

· Amkor Technology, Inc. (USA)

· JCET Group Co., Ltd. (China)

· Powertech Technology Inc. (PTI) (Taiwan)

· Tongfu Microelectronics Co., Ltd. (China)

· Tianshui Huatian Technology Co., Ltd. (China)

· UTAC Holdings Ltd. (Singapore)

· ChipMOS TECHNOLOGIES INC. (Taiwan)

· King Yuan ELECTRONICS CO., LTD. (KYEC) (Taiwan)

· Lingsen Precision Industries, Ltd. (Taiwan)

· and other active players.

Key Industry Developments

News 1: In June 2025, a leading Taiwanese OSAT provider announced a multi-billion dollar investment to construct a new state-of-the-art facility focused exclusively on advanced packaging for AI accelerators and high-performance computing (HPC) chips. This strategic expansion is a direct response to the unprecedented demand from cloud computing and AI companies. The new factory will specialize in CoWoS (Chip-on-Wafer-on-Substrate) and other 2.5D/3D packaging technologies, significantly increasing global capacity for next-generation silicon.

News 2: In September 2025, a premier US-based OSAT company announced a strategic collaboration with a top EDA (Electronic Design Automation) software firm. The partnership will deliver a fully qualified design-to-manufacturing flow for chiplet-based designs. This initiative aims to simplify the complex process of heterogeneous integration, providing chip designers with a verified set of tools and manufacturing guidelines. It is expected to lower the barrier to entry for developing custom SiP solutions and accelerate the adoption of chiplet architectures across the industry.

Key Findings of the Study

· The Assembly & Packaging service and the Communications application segments are the largest contributors to the OSAT market.

· The Asia-Pacific region, particularly Taiwan, overwhelmingly dominates the market due to its established semiconductor manufacturing ecosystem.

· Market growth is driven by the fabless business model and the increasing technical complexity and cost of advanced semiconductor packaging.

· A primary market trend is the industry's shift towards heterogeneous integration and chiplet-based designs, creating new opportunities for OSATs.